【税务讲堂】开店卖辣条,税收优惠有多大?(下)

2021-10-30 18:41 来源:深圳南山税务

←滑动查看中英文对照→

Slide to see English Version

自2020年3月1日至2021年12月31日,增值税小规模纳税人,适用3%征收率的应税销售收入,减按1%征收率征收增值税;适用3%预征率的预缴增值税项目,减按1%预征率预缴增值税。

其中,自2020年3月1日至2021年3月31日,对湖北省增值税小规模纳税人,适用3%征收率的应税销售收入,免征增值税;适用3%预征率的预缴增值税项目,暂停预缴增值税。

依据:财税[2021]7号文、财税[2020]13号文

←滑动查看中英文对照→

Slide to see English Version

From March 1, 2020 to December 31, 2021, small-scale VAT taxpayers to which a VAT levy rate of 3% is applicable may pay VAT at the reduced levy rate of 1%; they may also pre-pay VAT at the reduced pre-levy rate of 1% for their items subject to a pre-levy rate of 3%.

From March 1, 2020 to March 31, 2021, small-scale VAT taxpayers in Hubei Province, to which a VAT levy rate of 3% is applicable, shall be exempted from VAT; the VAT pre-payment for their items subject to a pre-levy rate of 3% will be suspended.

Basis: Ministry of Finance and the State Administration of Taxation, Document No.7, 2021 and No. 13, 2020.

也就是说

That is to say

3%减按1%征收率政策

the preferential policy on levy rate

将延续到2021年12月31日

will be effective until December 31, 2021

让我们去到税政知识小课堂

Let's attend the tax knowledge class

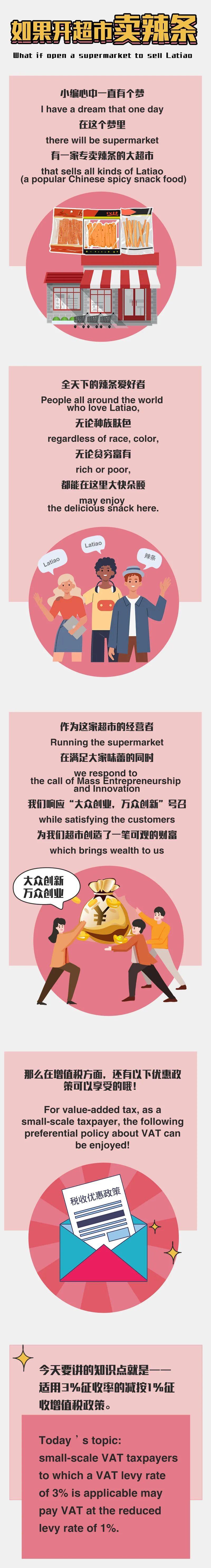

以这家辣条超市为例

take the Latiao supermarket as an example

跟同学们一起探讨这项政策

and have a discussion with the students

例 1 / Case 1

该超市第一季度、第二季度分别要缴纳增值税的金额是多少呢?

What’s the amount of VAT for the supermarket in the first quarter? What about the second quarter?

小明同学举手了!

Xiaoming raises his hand!

小明同学慌慌张张地抢答

点击下方空白查看

↓

Click the blank to view

the Xiaoming’s answer

↓

老师我知道!这个知识点你上节课就说过了。这家超市作为小规模纳税人,第一季度销售额没有超过当时季度30万元免征增值税的标准,可以享受免征优惠。而第二季度超过了现在季度45万元免征增值税的标准,需要申报缴纳增值税50万元×3%=1.5万元。

I know! We’ve talked about this last time. As a small-scale taxpayer, the supermarket can enjoy the exemption from VAT because its sales in the first quarter did not exceed the standard (300,000 yuan for a quarter) at that time. The second quarter exceeded the current standard (450,000 yuan for a quarter) for VAT exemption, so the supermarket needs to declare the payment of VAT 500,000 yuan ×3%= 15,000 yuan.

(上下滑动查看/Slide to view)

“小明同学你只答对了一半,一看你刚刚就没听讲。”

“You are only half right. You didn’t listen to what the teacher said, did you?”

优秀的课代表猛地站起来纠正

点击下方空白查看

↓

Click the blank to view

the representative's answer

↓

这超市第二季度应税收入超过了45万,的确需要缴纳增值税,但目前已将3%减按1%征收率政策延续到2021年12月31日。因此这家超市第二季度需申报缴纳增值税50万元×1%=0.5万元(计算公式:不含税销售额×1%)。

The supermarket's taxable income in the second quarter exceeded 450,000 yuan, so it does need to pay VAT, but the tax rate has been reduced from 3% to 1% until December 31, 2021. Therefore, in the second quarter, the supermarket needs to declare and pay VAT of 500,000 yuan ×1%= 5,000 yuan (calculation formula: sales excluding tax ×1%).

(上下滑动查看/Slide to view)

课代表说得没错,第一季度可以享受免征优惠,第二季度的征收率减按1%计算。小明同学还记得上节课讲的免征优惠政策也棒棒哒!

The representative is right. The exemption policy can be enjoyed for the first quarter’s income and the VAT for the second quarter may be paid at the reduced levy rate of 1%. Xiaoming still remembers the exemption policy we talked about before. It’s great!

“ 小明同学,给你一个弥补错误的机会,下一题由你来回答。”

“Xiaoming, I'll give you a chance to make up for your mistake, and you'll take the next question.”

例 2 / Case 2

这家超市2021年1月份给购方开具了3%征收率的增值税专用发票(不含税金额为5万元),一季度的25万不含税收入是否还能享受免征增值税政策呢?

In January 2021, the supermarket issued a VAT special invoice with a 3% tax rate (50,000 yuan excluding tax) to the buyer. For the first quarter's income of 250,000 yuan(excluding tax), can the VAT exemption policy be enjoyed?

“这回肯定没错!”

“It's gonna be right this time!”

小明同学胸有成竹地回答

点击下方空白查看

↓

Click the blank to view

Xiaoming's answer↓

当然可以。若开具了专票,则需按发票上注明的销售额和适用征收率计算缴纳增值税。对于没有开具专票的部分,仍可以享受免税。对已开专票的部分,若要享受免税政策,需将全部联次追回或按规定开具红字专用发票。

Sure. If a special invoice is issued, VAT shall be calculated and paid according to the sales amount indicated on the invoice and the applicable levy rate. For the part without special invoices issued, you can still enjoy tax exemption policy. For the part with special invoices issued, you need to retrieve all sheets of the invoices or issue a red-letter VAT invoice according to the regulations if you want to enjoy the tax exemption policy.

(上下滑动查看/Slide to view)

相关文件 / Related documents

1.《财政部 税务总局关于延续实施应对疫情部分税费优惠政策的公告》(2021年第7号);

2.《财政部 税务总局关于支持个体工商户复工复业增值税政策的公告》(2020年第13号);

3.《国家税务总局关于进一步优化增值税优惠政策办理程序及服务有关事项的公告》(2021年第4号);

4.《国家税务总局关于在新办纳税人中实行增值税专用发票电子化有关事项的公告》(2020第22号);

5.《国家税务总局关于支持个体工商户复工复业等税收征收管理事项的公告》(2020年第5号);

6.《国家税务总局关于红字增值税发票开具有关问题的公告》(2016年第47号)。

来源:深圳税务